td ameritrade tax rate

As a result the principal cost of 96357 per bond multiplied by the quantity of 5 bonds gives us a total principal cost of 481785. Each time you purchase a security the new position is a distinct and separate tax lot even if you already owned shares of the same security.

How Do Tax Brackets Actually Work Youtube

Check the background of TD Ameritrade on FINRAs BrokerCheck.

. See all contact numbers. Depending on your activity and portfolio you may get your form earlier. Define your fixed-income strategy with the one-to-one guidance of TD Ameritrade Fixed Income Specialists.

A tax lot is a record of a transaction and its tax. Effective August 16 2022. The TD Ameritrade Mobile app now has up to 7 years of tax documents and 10 years of statements available from your iOS or Android device.

Hi I live abroad and I recently wire transfered 1000 from an international bank account to my TD ameritrade account. 0009946 per options contract. Schwab New York Municipal Money Fund - Investor Shares 1 Tax-Free.

However I only received 978 in my actual balance. Reinforce your retirement savings with a tax-deferred fixed rate or immediate income annuity through TD Bank with tax advantages great rates custom payout schedules. This is a secure page.

Select your federal tax rate. With the exception of the 10 and 35 brackets the current tax rates are. TD Ameritrade FDIC Insured Deposit Account Rates - Core.

Retrieve your tax documents or. For most investors the rate is likely to be 15. Their unbiased recommendations and analysis can help you build a portfolio that.

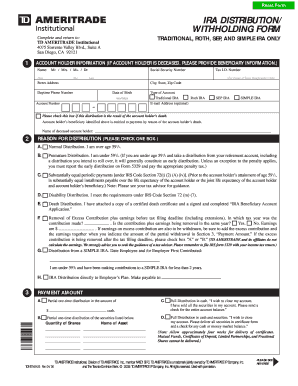

TD Ameritrade does not provide tax advice and cannot guarantee accuracy of state tax withholding information as state laws are subject to change and interpretation. When setting base rates TD Ameritrade considers indicators like commercially recognized interest rates. Select your state of residence.

The marginal tax rates in 2017 before the tax reform were 10 15 25 28 33 35 and 396. If an investment is sold within the first 12 months its considered a short-term gain which generally receives less favorable. Margin interest rates vary due to the base rate and the size of the debit balance.

Withholding at a rate of 28 on all taxable dividends interest sales proceeds including those from options transactions. 00000229 per 100 of transaction proceeds. Subject to change without prior notice.

Before investing carefully consider the funds investment objectives risks. When setting the base rate TD Ameritrade considers indicators including but not limited to commercially recognized interest rates industry conditions relating to the extension of credit. Your taxable equivalent yield is Click the Calculate Button.

Not required to file a US. Enter the yield to maturity or yield to call of the Municipal bond. TD Ameritrade automatically calculates the.

To log in upgrade to. 225 fee per contract plus exchange regulatory fees Youll have easy access to a variety of available investments when you trade futures with a TD Ameritrade account. With tax rates rising your net income will likely decline.

Unsupported Chrome browser alert. The simple answer to why tax rates sunsetting in 2026 matters for you is that all tax rates will be going up. And foreign corporations capital gains.

My bank also charged. Ordinary dividends of 10 or more from US.

Td Ameritrade Ira Fees Roth Retirement Account Cost 2022

Td Ameritrade Review 2022 Pros Cons And How It Compares Nerdwallet

Td Ameritrade Review Weigh The Pros And Cons Money

How To Read Your Brokerage 1099 Tax Form Youtube

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

/Etrade-core-portfolios-vs-TD-Ameritrade-Essential-Portfolios1-1c335a1e84ea4fd0b274f5762677905f.png)

E Trade Core Portfolios Vs Td Ameritrade Essential Portfolios Which Is Best For You

How To Close Td Ameritrade Account 2022

2022 Td Ameritrade Review Pros Cons Benzinga

Td Ameritrade Essential Portfolios Review Smartasset Com

Choose The Right Default Cost Basis Method Novel Investor

Schwab And Td Ameritrade To Take Big Revenue Cuts After Dropping Commissions Financial Planning

Td Ameritrade Forms Fill Out And Sign Printable Pdf Template Signnow

How Tax Brackets Work Novel Investor

Tax Efficient Investing Ease Uncle Sam S Bite Ticker Tape

Capital Gains Taxes Explained There Are Two Types Of Capital Gains Short Term And Long Term Taxes Can Impact The Growth Of Your Portfolio So It S Important To Understand How By Td

Tax Bite Capital Gains Short Term And Long Term Inv Ticker Tape

Td Ameritrade Substitute Payments 2 3m Class Action Lawsuit Settlement Top Class Actions